Strategic Consulting and

Growth Advising.

We bring our clients 20 years of executive leadership, management, investment and industry experience, deep sector expertise, and a trusted network of industry and institutional relationships.

Industrials

Digital Commerce

Life Sciences

Renewable Energy

Energy Transition

Infrastructure

Call Centers

Logistics

Technology

Strategic Consulting and Growth Advising.

We bring our clients 20 years of executive leadership, management, investment and industry experience, deep sector expertise, and a trusted network of industry and institutional relationships.

Our Advantage is Yours

Green Street Advisory, led by Dustin Muscato, is a solutions-oriented provider of strategic advisory and capital sourcing services for businesses across a range of stages of growth and industry sectors. We actively collaborate with leadership, engaging in on-the-ground, hands-on partnership to identify a company’s unique needs, develop a comprehensive strategy, secure required resources and then execute on innovative solutions to grow their businesses. We rely on 20 years of executive leadership, management, investment and industry experience, deep sector expertise, and a trusted network of industry and institutional relationships.

Our Advantage is Yours

Green Street Advisory, led by Dustin Muscato, is a solutions-oriented provider of strategic advisory and capital sourcing services for businesses across a range of stages of growth and industry sectors. We actively collaborate with leadership, engaging in on-the-ground, hands-on partnership to identify a company’s unique needs, develop a comprehensive strategy, secure required resources and then execute on innovative solutions to grow their businesses. We rely on 20 years of executive leadership, management, investment and industry experience, deep sector expertise, and a trusted network of industry and institutional relationships.

Capabilities & Offerings

Strategic Advisory

We work with company and fund leadership to execute on optimal strategies for business growth via transactional activity and advisory services including:

-M&A

-Add-on transactions

-Joint ventures & strategic

partnerships

-Realizations

-Industry expert advisor to funds

-Transaction execution

-Due diligence analysis

Financing & Capital Formation

We provide differentiated access to capital utilizing direct relationships at highly-targeted institutional capital providers (investors, banks and non-bank lenders). Capital sources include:

-Growth equity

-Private equity

-Project financing

-Venture debt

-Working capital

-Asset-based debt

-Specialty financial partnerships (industry-specific, bespoke)

Leadership Management & Consulting

We coach C-level leadership, founders, and/or management in necessary capabilities and skills to be able to successfully execute on their growth initiatives, which may include:

-Launching new lines of business

-Entering new geographic markets

-Acquiring strategic talent

-Navigating distressed situations

-Coaching through turn-arounds

-Board participation

-Benchmarking status vs. competitors

Special Situations & Projects

We develop solutions to business needs that arise with new investor requirements, customer demand, or unexpected situations, including:

- ESG / Impact

-Bankruptcy

-Short-fuse situations

-Capital short-fall

Capabilities & Offerings

Strategic

Advisory

Financing &

Capital Formation

Leadership &

Management Consulting

Special

Situations

We work with company and fund leadership to execute on optimal strategies for business growth via transactional activity and advisory services including:

We provide differentiated access to capital utilizing direct relationships at highly-targeted institutional capital providers (investors, banks and non-bank lenders). Capital sources include:

We coach C-level leadership, founders, and/or management in necessary capabilities and skills to be able to successfully execute on their growth initiatives, which may include:

We develop solutions to business needs that arise with new investor requirements, customer demand, or unexpected situations, including:

-M&A

-Add-on transactions

-Joint ventures & strategic

partnerships

-Realizations

-Industry expert advisor to funds

-Transaction execution

-Due diligence analysis

-Growth equity

-Private equity

-Project financing

-Venture debt

-Working capital

-Asset-based debt

-Specialty financial partnerships (industry-specific, bespoke)

-Launching new lines of business

-Entering new geographic markets

-Acquiring strategic talent

-Navigating distressed situations

-Coaching through turn-arounds

-Board participation

-Benchmarking status vs. competitors

- ESG / Impact

-Bankruptcy

-Short-fuse situations

-Capital short-fall

Green Street Projects - Select Snapshot

[CURRENT]

Energy retailer on establishment of a first-of-its kind, hybrid utility scale / residential solar business and development of comprehensive 3rd party consumer financing solution. Will build 50MW+ of projects valued at over $300M.

[CURRENT]

Advising tech-enabled energy retailer through a distressed situation and restructuring.

[CURRENT]

Advising investment sponsor on DG stand-alone battery storage strategy and establishing complete ecosystem for strategy including site developers, technology providers, EPC candidates, additional industry expert financial advisors and prospective future project acquirers .

[COMPLETE]

Advised two solar developers on joint development partnership. Resulted in LOI and funding for 20MW Nevada solar project, valued at over $40M.

[COMPLETE]

Advised large ($1B+) credit-focused PE firm on evaluation of the acquisition of a senior loan portfolio. Advised a “no-go” conclusion due to lack of strategic fit between PE firm mandate and credit profile of portfolio

Green Street Projects - Select Snapshot

[CURRENT]

Energy retailer on establishment of a first-of-its kind, hybrid utility scale / residential solar business and development of comprehensive 3rd party consumer financing solution. Will build 50MW+ of projects valued at over $300M.

[CURRENT]

Advising tech-enabled energy retailer through a distressed situation and restructuring.

[CURRENT]

Advising investment sponsor on DG stand-alone battery storage strategy and establishing complete ecosystem for strategy including site developers, technology providers, EPC candidates, additional industry expert financial advisors and prospective future project acquirers .

[COMPLETE]

Advised two solar developers on joint development partnership. Resulted in LOI and funding for 20MW Nevada solar project, valued at over $40M.

[COMPLETE]

Advised large ($1B+) credit-focused PE firm on evaluation of the acquisition of a senior loan portfolio. Advised a “no-go” conclusion due to lack of strategic fit between PE firm mandate and credit profile of portfolio

Our Advantage in

Energy Transition

Industry leading resources, networks, and solutions for any scenario in energy transition. We have deep expertise in energy transition and the energy ecosystem (retail energy providers, energy brokers and aggregators, tech-enabled energy service providers, residential solar, solar financing, commercial and utility scale solar, project development, project financing, battery storage, etc.).

Our Advantage in

Energy Transition

Industry leading resources, networks, and solutions for any scenario in energy transition. We have deep expertise in energy transition and the energy ecosystem (retail energy providers, energy brokers and aggregators, tech-enabled energy service providers, residential solar, solar financing, commercial and utility scale solar, project development, project financing, battery storage, etc.).

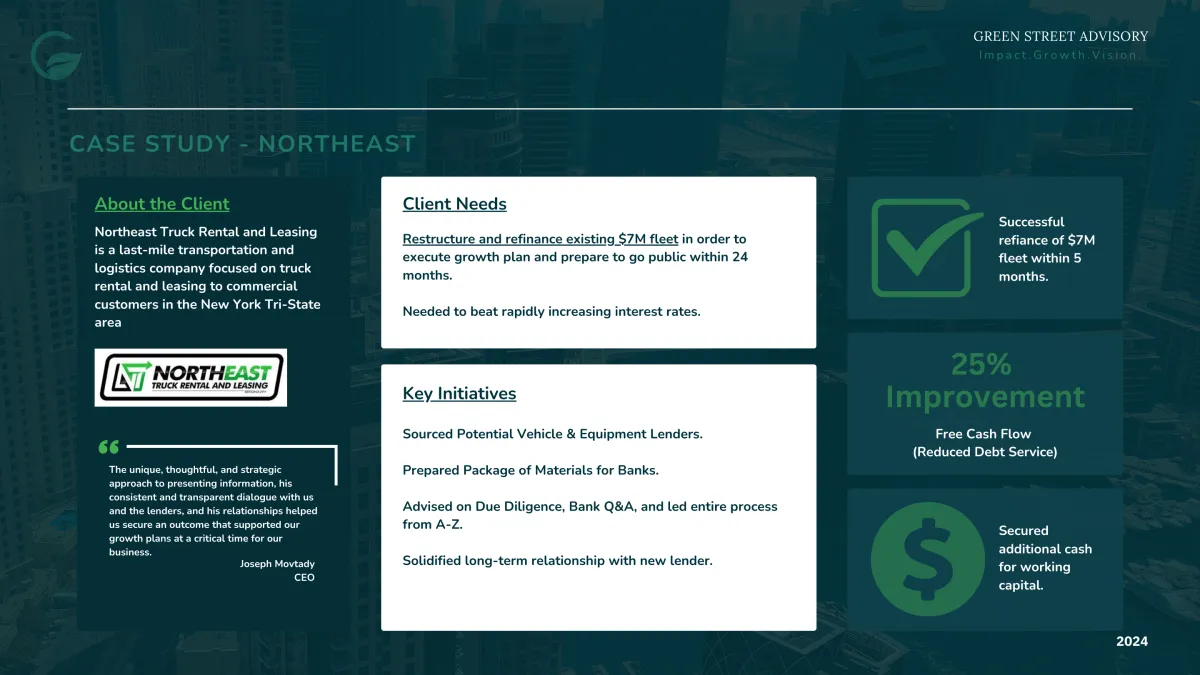

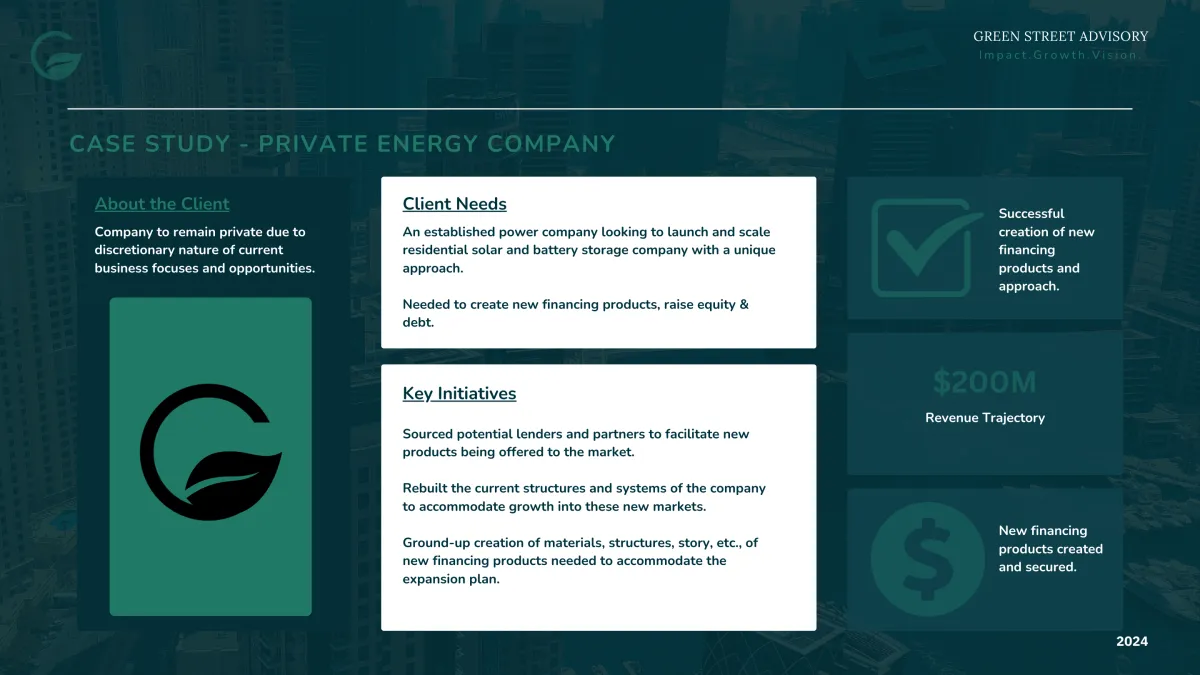

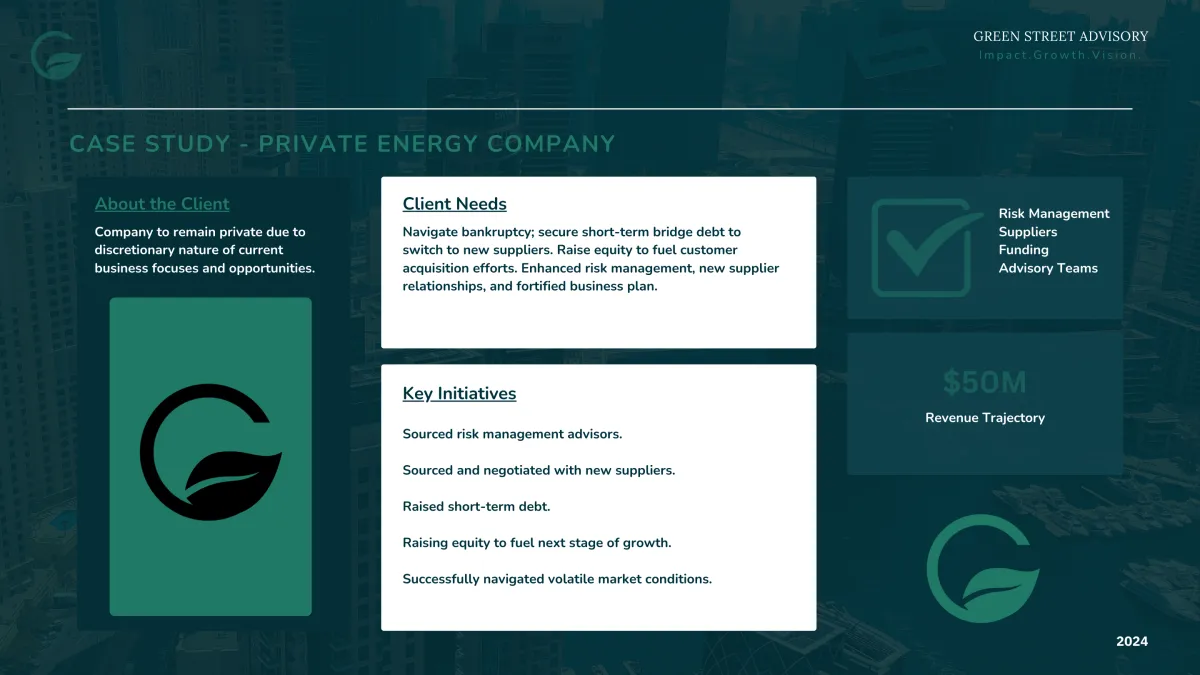

Case Studies

Our Promise to You

Partnership

Providing true hands-on partnership across a client’s business in order to help them achieve their business objectives.

Persistance

Failure is not an option – works tirelessly to ensure the objective is achieved and the client is satisfied.

Creativity

Provides unique and resourceful approaches to diagnosing and solving distinctive client needs as well as navigating expected and unexpected challenges.

Experience

Offers deep investment, management and industry experience and utilizes an extensive, trusted network of industry and institutional contacts to source, secure and manage the specific expertise a client needs.

Trust

Believes in establishing mutually-set criteria for success to ensure transparency and accountability through which lasting value is created for clients.

Our Promise to You

Partnership

Persistance

Creativity

Experience

Trust

Providing true hands-on partnership across a client’s business in order to help them achieve their business objectives.

Failure is not an option – works tirelessly to ensure the objective is achieved and the client is satisfied.

Provides unique and resourceful approaches to diagnosing and solving distinctive client needs as well as navigating expected and unexpected challenges.

Offers deep investment, management and industry experience and utilizes an extensive, trusted network of industry and institutional contacts to source, secure and manage the specific expertise a client needs.

Believes in establishing mutually-set criteria for success to ensure transparency and accountability through which lasting value is created for clients.

Contact Us

Interested in working with us, or learning more? Fill out the form and a member of our team will reach out promptly. Thanks!

Contact Us

Interested in working with us, or learning more? Fill out the form and a

member of our team will reach out promptly. Thanks!